How Tulsa Ok Bankruptcy Specialist can Save You Time, Stress, and Money.

Table of ContentsOur Chapter 13 Bankruptcy Lawyer Tulsa PDFsThe Only Guide to Best Bankruptcy Attorney TulsaThe Definitive Guide to Chapter 13 Bankruptcy Lawyer TulsaA Biased View of Bankruptcy Attorney TulsaSome Known Details About Tulsa Ok Bankruptcy Attorney

The statistics for the other primary kind, Chapter 13, are also worse for pro se filers. Suffice it to say, speak with a lawyer or two near you who's experienced with insolvency law.Several lawyers also supply totally free assessments or email Q&A s. Benefit from that. (The charitable app Upsolve can aid you find totally free appointments, sources and legal assistance at no cost.) Ask if insolvency is undoubtedly the right choice for your scenario and whether they think you'll certify. Prior to you pay to file bankruptcy types and blemish your debt report for approximately one decade, inspect to see if you have any viable choices like financial debt negotiation or charitable credit scores counseling.

Advertisement Now that you have actually decided personal bankruptcy is indeed the appropriate training course of action and you ideally removed it with a lawyer you'll require to obtain started on the documents. Prior to you dive into all the main bankruptcy kinds, you need to get your own records in order.

9 Easy Facts About Chapter 7 - Bankruptcy Basics Shown

Later on down the line, you'll in fact require to verify that by divulging all type of details regarding your monetary affairs. Here's a fundamental listing of what you'll need when traveling ahead: Recognizing files like your chauffeur's permit and Social Protection card Income tax return (approximately the previous four years) Evidence of earnings (pay stubs, W-2s, freelance incomes, earnings from assets as well as any type of income from government benefits) Financial institution statements and/or pension statements Proof of worth of your properties, such as vehicle and property evaluation.

You'll wish to comprehend what kind of financial debt you're trying to solve. Debts like child assistance, alimony and particular tax obligation debts can not be released (and bankruptcy can not halt wage garnishment pertaining to those financial debts). Trainee lending financial obligation, on the various other hand, is possible to discharge, however note that it is challenging to do so (Tulsa bankruptcy attorney).

You'll wish to comprehend what kind of financial debt you're trying to solve. Debts like child assistance, alimony and particular tax obligation debts can not be released (and bankruptcy can not halt wage garnishment pertaining to those financial debts). Trainee lending financial obligation, on the various other hand, is possible to discharge, however note that it is challenging to do so (Tulsa bankruptcy attorney).If your earnings is expensive, you have an additional choice: Chapter 13. This alternative takes longer to settle your debts because it requires a long-lasting payment strategy typically three to five years prior to several of your continuing to be financial obligations are wiped away. The declaring process is also a lot more intricate than Chapter 7.

10 Simple Techniques For Chapter 7 Vs Chapter 13 Bankruptcy

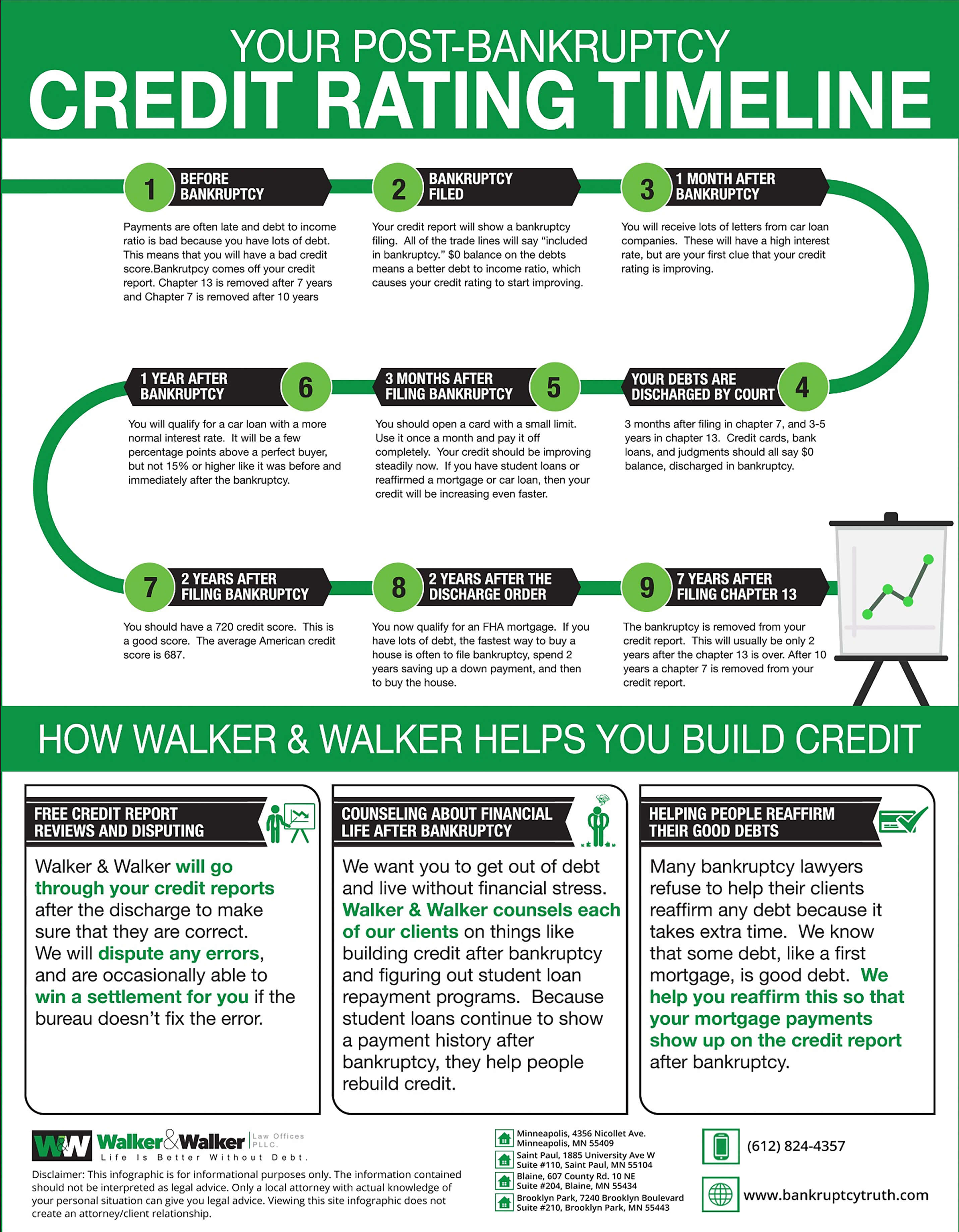

A Chapter 7 bankruptcy stays on your credit report for 10 years, whereas a Phase 13 personal bankruptcy drops off after seven. Before you submit your personal bankruptcy types, you have to initially complete a necessary course from a credit rating counseling firm that has been accepted by the Division of Justice (with the remarkable exemption of filers in Alabama or North Carolina).

The course can be completed online, personally or over the phone. Programs commonly cost in between $15 and $50. You must finish the training course within 180 days of declaring for insolvency (bankruptcy lawyer Tulsa). Make use of the Division of Justice's internet site to locate a program. If you stay in Alabama or North Tulsa OK bankruptcy attorney Carolina, you have to select and finish a program from a checklist of individually approved carriers in your state.

Getting My Tulsa Ok Bankruptcy Attorney To Work

Examine that you're submitting with the correct one based on where you live. If your irreversible home has actually moved within 180 days of filling, you should file in the area where you lived the higher part of that 180-day duration.

Generally, your personal bankruptcy lawyer will work with the trustee, yet you might need to send the individual records such as pay stubs, tax returns, and financial institution account and bank card statements directly. The trustee that was just selected to your situation will quickly set up an obligatory conference with you, called the "341 conference" due to the fact that it's a demand of Section 341 of the united state

You will need to give a timely checklist of what certifies as an exemption. Exemptions may apply to non-luxury, key vehicles; essential home items; and home equity (though these exceptions guidelines can vary extensively by state). Any type of property outside the listing of exceptions is thought about nonexempt, and if you don't give any listing, after that all your residential or commercial property is taken into consideration nonexempt, i.e.

You will need to give a timely checklist of what certifies as an exemption. Exemptions may apply to non-luxury, key vehicles; essential home items; and home equity (though these exceptions guidelines can vary extensively by state). Any type of property outside the listing of exceptions is thought about nonexempt, and if you don't give any listing, after that all your residential or commercial property is taken into consideration nonexempt, i.e.The trustee would not offer your cars to quickly settle the lender. Instead, you would certainly pay your lenders that quantity throughout your settlement plan. A typical mistaken belief with personal bankruptcy is that when you submit, you can quit paying your debts. While bankruptcy can help you wipe out a lot of your unsafe financial debts, such as past due medical expenses or personal financings, you'll wish to maintain paying your month-to-month payments for safe financial obligations if you wish to keep the home.

Tulsa Ok Bankruptcy Attorney Things To Know Before You Buy

If you go to danger of repossession and have actually worn down all various other financial-relief options, after that declaring Chapter 13 may delay the foreclosure and help conserve your home. Eventually, you will certainly still require the Tulsa bankruptcy lawyer revenue to continue making future home loan repayments, along with paying off any late settlements throughout your settlement plan.

The audit could delay any kind of financial debt alleviation by a number of weeks. That you made it this far in the procedure is a decent indication at the very least some of your debts are qualified for discharge.